The filing of Taxes Forms is done every month. You need to have access to the following:

These sites/sheets will help you get the correct data for proper Tax filing.

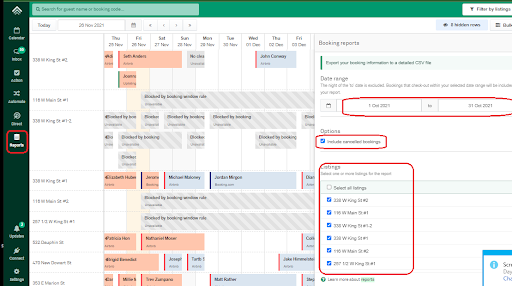

The filing of Request report from Uplisting with dates from 1st up to the last day of the monht

Please note, to tick on “Include Cancelled Bookings”. Also, if you are getting a report for Lancaster county only, tick on all the locations except for Shenandoah.

Submit the following:

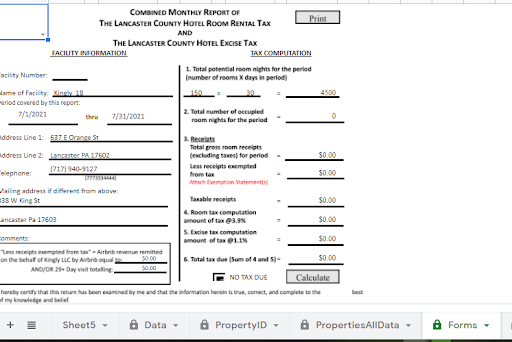

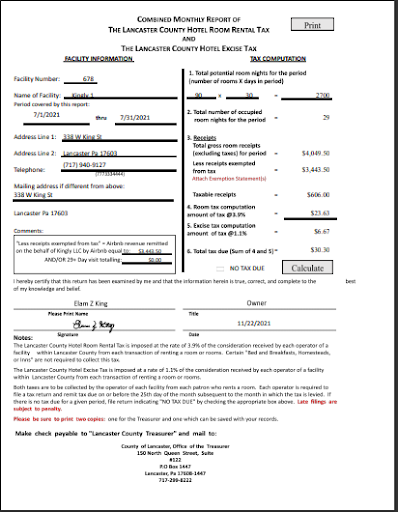

1. Forms! for each property. Make sure the file format is “02-2021_338 W King #1”

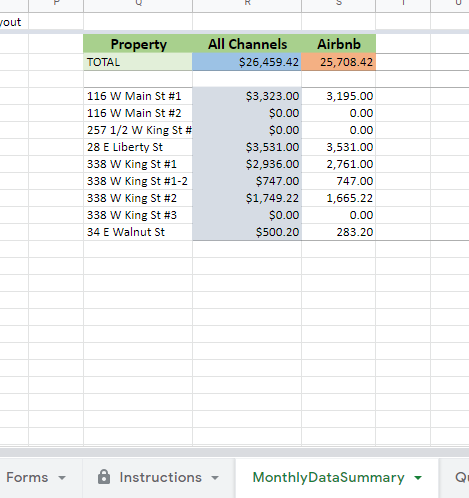

2. MonthlyDataSummary! (1 for each property).

3. If more than 29 days fill out Permanent Residence Form

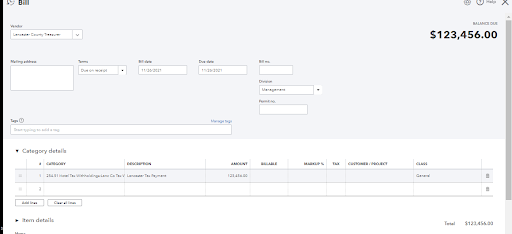

We need the data we have versus the numbers indicated in Quickbooks.

Here is the video: https://vimeo.com/659768752/26d979f7f7

Training videos on how to enter the State and Sales tax.

https://drive.google.com/drive/folders/1sqRZwQIL850jeUtzF5Hv42n_6lpn2btn?usp=sharing